Tailored to High Net Worth Individuals & Those Looking To Retire

4-9% Compounding Monthly Returns

Completely Hands-Off with AI Trading:

Now Available to the Public

Watch the video below to see how it works.

4.9/5 star reviews

Thousands of happy customers worldwide.

Consistent and predictable

Our Promise

4-9% historical Monthly Returns.

Track record verified by MyFXBooks

Can trade with just $2k.

Instituional-grade.

30-Day Performance Based Protection*

Comparison with

Other Algorithms

Claims of 20%/mo+ returns

Less than 1 year track records

Need at least a $10k balance to trade with

Retail-grade

Conditional risk reversal

Live Account

Our Partners

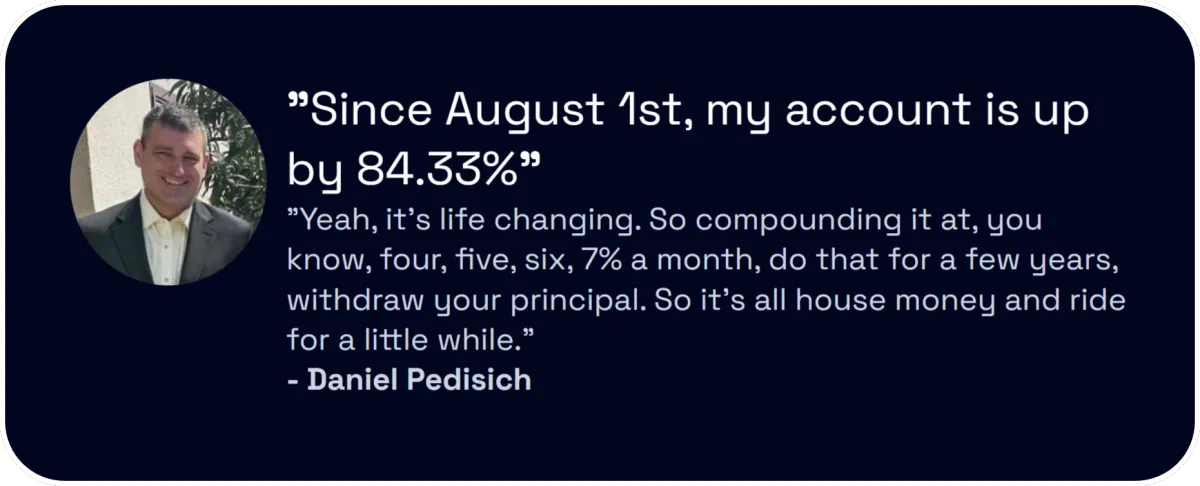

Success Stories from people like YOU

STILL GOT QUESTIONS?

Frequently Asked Questions

If this works why doesn't everyone do it?

This technology hasn't been accessible to the average person until recently. Only with recent advancements in AI has it become more mainstream. The tech itself isn't new—it was once exclusively reserved for hedge funds, but now it's becoming available to a broader audience.

At Ridge, we still work with hedge funds, large institutional investors, and high-net-worth individuals. In fact we originally developed this technology to manage our own capital. However, the market of regular investors is much larger. By sharing our technology with you, we're able to scale.

What is a trading algorithm

Normally, trading requires a lot of complex knowledge, quick decision-making, and years of practice to get good at which can be overwhelming and inaccessible to the average person.

Our software makes all those tough decisions automatically, without getting swayed by emotions, making it easier for anyone to participate without needing to learn all the complicated terms and strategies used in trading.

Is your trading strategy safe?

Ridge Capital Solutions offers one of the safest and most reliable track records in the market. Our flagship algorithm, R-2, has consistently delivered 4-9% monthly returns over a 5-year period.

Our institutional products, R-50 and R-400, further demonstrate our commitment to capital preservation with impressive performance, including a profitable 2023 with no negative months.

Are these returns sustainable?

Unlike many new algo trading companies, Ridge Capital Solutions has a proven history. Our algorithms have delivered consistent returns for over 5 years. We're institutional experts bringing our sophisticated technology to individual investors.

How does this perform in different market conditions, especially downturns?

Our strategy is unaffected by market downturns, and here's why: We focus on active trading rather than holding assets long-term.This allows us to capitalize on both market upswings and downturns, eliminating the vulnerability associated with extended asset holding during market downturns.

What are the minimum and maximum starting balances for your solutions?

Ridge Capital offers a range of solutions for various investment levels. R-50 requires a minimum of $50,000 and can manage up to $400,000. R-400 is suitable for balances from $400,000 to $5,000,000. For smaller investors, R-2 accommodates balances as low as $2,000 up to the R-50 minimum.

What brokers do you support?

R-50 is primarily used on Kubera Markets and also supports OX Securities, Vantage Markets, Fusion Markets, and Monaxa. It's compatible with any FOREX brokerage meeting our criteria, but we recommend the listed ones for optimal results.

Do you offer a money-back guarantee?

Yes, if our team sets up the software and you run it uninterrupted, we'll refund your licensing fee if you're not profitable in 30 days.

Is any manual management of the system required?

Our solutions are mostly automated, but we recommend regular performance monitoring and a weekly verification checklist to ensure connectivity between the platform and your brokerage. This can be done remotely via your VPS login.

How consistent are the returns across different market conditions?

R-50 and R-400 have a three-year track record with verified returns. They extract value from the market using machine learning strategies, generating consistent returns regardless of market direction. Our advanced risk management protocols mitigate external factors, ensuring stable performance.

What is the failure rate of the machine learning models, and how do you handle model breakdowns?

We've never had a system breakdown. Our AI system is cloud-based with built-in redundancy. Success depends on client VPS and brokerage connection to MT4 or MT5, which requires a simple weekly check.

Are your algorithms proprietary, or are they based on publicly available frameworks?

R50 and R400 are proprietary. They use an AI hub that scans market data for working strategies, ranking them by risk/reward. While the system is proprietary, individual strategies shift and may not all be proprietary.

How fast is your AI at executing trades, and how does this speed compare to competitors?

Latency is mainly a broker issue. Our system operates with minimal latency, but broker latency may vary.

Have you had your historical performance independently verified by a reputable third party?

We use FXblue and Myfxbook to audit accounts, providing a live link and historical trade data. Open trades aren't shown to prevent copy-trading.

How do you account for survivorship bias or selection bias in your performance reporting?

Our AI system is neutral and unbiased, making decisions based on data, not hunches or hopes.

What is your plan to maintain or improve alpha generation over time as strategies become widely adopted?

Our system constantly evolves and adjusts based on learnings. We continuously improve our products through real market feedback and have a roadmap for future enhancements.

How did your strategies perform during specific high-stress periods like the 2008 financial crisis or the 2020 COVID-19 crash?

R-50 and R-400 weren't live during those periods. However, their design considers data from those times.

What happens to your models in the event of geopolitical shocks, sudden regulatory changes, or extreme market manipulation?

The worst outcome is hitting position stop losses. R-50 and R-400 employ multiple strategies and have risk management in place. Adjustments are made when needed, but overall safety protocols remain intact.

What is the maximum allowable loss in a single day, week, or month before trades are halted?

Each trade and subsystem has risk limits. R-50's average risk per subsystem is 2.8%, and the total system loss is limited to 30%. R-400 has similar risk management.

What is your contingency plan in the event of a major technology failure or cyberattack?

We have redundancy, failover systems, and a recovery protocol. Trade execution is segmented, allowing manual management if needed. Cybersecurity measures include sandboxing, encryption, and isolation of compromised systems.

How do your strategies correlate with traditional market indices or other algorithmic strategies?

Algorithmic strategies are limited by their static nature. Our AI system intelligently manages a portfolio of strategies, evolving over time. Our returns significantly exceed traditional market benchmarks.

Who monitors the system's operations, and what are their qualifications?

A dedicated tech team monitors the AI system 24/7. Our development and oversight team leaders have extensive experience in AI and finance.

When does human intervention override the decisions made by the system?

Human intervention is minimized, as human decision-making is often flawed. It's only permitted during system malfunctions. Regular audits are conducted to identify and address potential shortcomings.

Can I have a live, real-time feed of trades being executed and their rationale?

We don't provide access to proprietary data, but we can offer limited-time access to live accounts via an investor password.

What markets or instruments have insufficient liquidity for your strategy, and how do you mitigate this?

The FOREX market is highly liquid. R-50 and R-400 are designed to manage liquidity concerns by using appropriate brokers and, in the case of R-400, executing smaller positions. We haven't experienced liquidity issues.

How much capital can the strategy manage before performance degrades?

R-50 is suitable for $50,000-$400,000. R-400 can handle up to $25 million. For larger amounts, we suggest using two accounts with different brokers.

Can I have a live, real-time feed of trades being executed and their rationale?

We don't provide access to proprietary data, but we can offer limited-time access to live accounts via an investor password.

How do you handle crowding risk if multiple clients use similar strategies?

We offer limited licenses annually and don't sell to the masses, so crowding risk isn't a concern.

How do you ensure compliance with upcoming and changing regulations in different jurisdictions?

In the US, we offer our product as Software as a Service, complying with regulations. In Europe and abroad, we partner with a licensed money manager. We stay informed about regulatory changes and adapt accordingly.

Do you trade your own capital using the same strategies? If not, why?

Yes, we developed our products to manage our own capital.

How do you ensure my data is not shared with other clients or used for proprietary gains?

We only store basic contact information and your MT4/5 account number, which is not sensitive information. Only you have access to your account.

Who are your current investors, and what are their typical risk profiles and capital allocations?

Our clients are mainly family offices, hedge funds, and high-net-worth individuals. They typically allocate a small portion of their funds to high-risk, high-reward investments like ours.

Have you been compared to similar solutions in independent research or publications?

Not to our knowledge, as there are few publicly available AI systems like ours.

What percentage of your investors renew or stay invested after their initial term?

We have a 100% client retention rate abroad and anticipate the same in the US.

If multiple investors want to redeem simultaneously, how do you manage liquidity?

Liquidity is managed by the client's chosen broker, not Ridge Capital.

How will you keep investors informed during market or system disruptions?

We have a private Telegram channel for announcements and issue monthly reports covering performance and adjustments.

Can the solution be tailored to my specific risk tolerance or return objectives?

Yes, each client sets their own risk parameters with our team's assistance.

What is the ideal investment horizon for your strategy to maximize returns?

R-50 and R-400 are intended for continuous, indefinite use. There's no mandatory lock-up period or preferred hold time.

Can you share anonymized case studies of current investors who have experienced significant success?

We respect client privacy and don't ask for referrals or testimonials. We can provide limited data via FXblue/Myfxbook links or investor login credentials for some accounts.

Copyrights 2025 | Steady Stream ™ | Terms & Conditions

Trading FX or CFDs on leverage is high risk and your losses could exceed deposits. U.S. Government Required Disclaimer - Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts. The purchase, sale or advice regarding a currency can only be performed by a licensed Broker/Dealer. Neither us, nor our affiliates or associates involved in the production and maintenance of these products or this site, is a registered Broker/Dealer or Investment Advisor in any State or Federally-sanctioned jurisdiction. All purchasers of products referenced at this site are encouraged to consult with a licensed representative of their choice regarding any particular trade or trading strategy. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. The past performance of any trading system or methodology is not necessarily indicative of future results. Clearly understand this: Information contained in this product are not an invitation to trade any specific investments. Trading requires risking money in pursuit of future gain. That is your decision. Do not risk any money you cannot afford to lose. This document does not take into account your own individual financial and personal circumstances. It is intended for educational purposes only and NOT as individual investment advice. Do not act on this without advice from your investment professional, who will verify what is suitable for your particular needs & circumstances. Failure to seek detailed professional personally tailored advice prior to acting could lead to you acting contrary to your own best interests & could lead to losses of capital. *CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.